By Jen Nelson

Historically, elections have had minimal direct impact on real estate values in the short term. Here are a few key facts to illustrate how real estate trends tend to hold steady, even in election years.

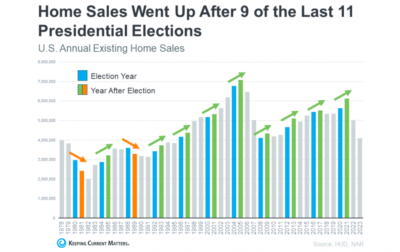

SALES: Since 1978, home sales have gone UP after 9 of the last 11 elections. Home sales tend to dip just around elections – in November but we’ve already seen an uptick in activity:

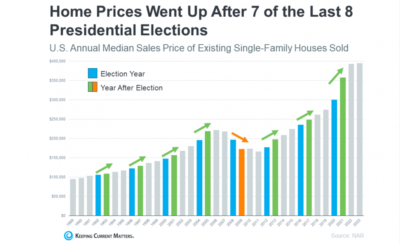

PRICE: Home prices have gone up after nearly all elections:

SUPPLY AND DEMAND: According to the National Home Builders Association we have a significant shortage of homes which will take years to build to get back to a balanced market. In addition, the Boomer generation have opted to keep their larger homes as rentals rather than sell them like previous generations adding to a constricted supply. Bottom line, it’s well stated by our economists:

“While Presidential elections do have some impact on the housing market, the effects are usually small and temporary.” As Lisa Sturtevant, Chief Economist at Bright MLS, says: “Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.”

So, when you’re looking to invest, remember that timing the market around election cycles may not be as crucial as understanding long-term trends and maintaining a clear investment strategy. As we navigate the nuances of this election season, keep in mind that real estate’s true value lies in its stability and its potential to build wealth over time.

Investor Wins in Q4

Every year around this time, our investor clients reach out, with tax planning strategies in hand, ready to make some real estate investments. And each year we’re thrilled to find some great values to help them build wealth and diversify their portfolios.

A few recent investor client success stories:

1) Investor Buyers – Our investor was excited to begin their landlord journey and found a great property in the west valley that had positive cash flow year one – AND got seller credits for rate buy downs, closing costs and more. All for under $400k! Congrats!

2) Investor Sellers – We were thrilled to help a couple of investors sell multi family properties – after just a couple of weeks on the market. The new federal loan guidelines help us market to both investors and owner occupants who can put as little as 5% down on an owner occupied multi family property. Both our sellers received multiple offers. Congratulations!